Enabling the Next Generation of Business Growth.

Growth Blog.

Hearing the Right Voices?

Every marketing team has a critical role in a company’s success or failure. The marketing team connects the market (voice of the market) to the product and service groups, the sales organization and to executive leadership.

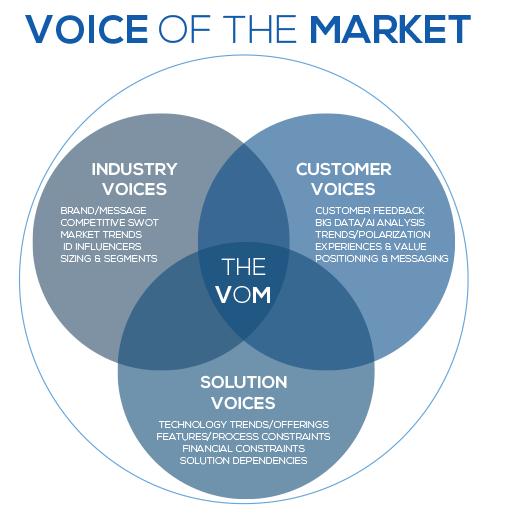

It’s critical that marketing organizations understand and listen to three “voices”, each guiding how the business goes forward to success. They are:

Voice of the Customer/Consumer: Touching actual customers and prospects. Taking a broad approach. Researching to uncover unmet needs or areas of dissatisfaction in any current product or service offerings. Gaining feedback on actual solutions, satisfaction with channels of delivery, post-sale support experiences, communications, image, considered alternatives and levels of satisfaction and loyalty. It’s about measuring the overall customer experience and learning where new opportunity exists.

Voice of the Solution: Probing and discovering available technology options and their features and benefits. Understanding usability and experience and learning of advantage or disadvantage in support, documentation and delivery mechanisms. It’s about discovery of new areas for improvement, differentiation and accelerated advantage.

Voice of the Market: Researching competitive offerings, discovering new entrants and potential partnerships is key. Identifying and partnering with key influencers for market traction and identification of trends before they go mainstream. Also, validate new opportunities and market attack plans before heavy investment is made

To obtain this needed information, here are some simple ideas for your consideration :

1. Customer Intelligence. Formalize regular, organized and consistent feedback mechanisms such as user/focus groups, surveys, and analysis that is impartial both at the regional and the global level. Look for consistent trends and polarized differences (this could be the make or break point for a certain brand, solution or product and service acceptance). Analyze sales, evaluation, purchasing and usage trends from your internal big data information sets to connect unknown or in not-so-obvious factors that customers seek. Finally take this feedback and adjust positioning and messaging in language that customers and prospects will understand.

2. Solution Intelligence. Fully evaluate various technology and product trends and associated vendors. Align known requirements to what the customer or prospect expects to receive, taking into consideration any feature, process or financial constraints that exist internally and externally. Evaluate solution acceptance and user experience feedback, then integrate everything early in the planning phases, development and ultimate delivery of the product or service solution.

3. Industry Intelligence. It’s important to put your finger on the pulse of your target industry early and often. Most companies undertake competitive SWOT analyses, based on current offerings and competitor perceptions. An even stronger method of gaining insight into the market characteristics is to conduct a series of simulation sessions, putting yourself in competitor’s shoes. Be prepared with historical data, current offerings and positioning, along with likely current and future sales strategies. Look broadly and deeply at upcoming disruptive technology, customer/user behaviors and economic trends that can influence how you go to market. Map out and size segments—both core and ancillary—then look for new core competence related segment opportunities.

These activities bring a much needed “outside in” viewpoint to key decisions and investments.

There are also examples where the Voice of the Market was left of, out or misused in, the process which led to failure.

– Device Bay. In 1996 Compaq sought to differentiate its upcoming desktop products by undertaking a comprehensive planning process, combining all elements of the Voice of the Market. A new technology was on the horizon that allowed for “hot swap” of disc drives and other storage devices which did not require rebooting the PC. The product team felt this technology had great potential to differentiate in an otherwise “commodity” marketplace. The planning process was flawless. However, the end result was flawed in that the data that showed that customers were not willing to pay a premium price for the new technology.

– New Coke. In the cola wars, Pepsi had been making great strides through their taste test advertising. People were defecting to Pepsi in large numbers—especially younger people who tuned into the “Pepsi Generation” advertising. IN response, Coke thought that key to renewed success was a new flavor, one that was more sweet and “peppier” than the original Coke. So, they created and launched (in 1985) the “new coke”.

At the introduction of the “new coke,” Coke ceased production of the original Coke. The introduction and following financial results showed these decisions to be a disaster as loyal Coke drinkers created a market revolution of protest and boycott. In fact, defections to Pepsi accelerated, where Pepsi overtook Coke as the largest cola soft drink. Because of the instant, negative market reaction Coke reintroduced “Coke Classic” (the original formula) just 90 days after the new coke introduction.

What was the mistake? Coke didn’t listen to their customers. By discontinuance of a well entrenched favorite, replacing it with the new coke, they infuriated a very loyal customer base.

– The Sharper Image. As a retailer of all sorts of gadgets, the Sharper Image was a pioneer. It seemed that the Sharper Image had all sorts of ‘cool’ stuff before anyone else did. At first, they were mail order only. But, then, stepping to a more traditional approach of other retailers, the Sharper Image allowed customers to play with gadgets before purchased in stores all over the place.

The Sharper Image never undertook complete Voice of the Customer activities. If the Sharper Image had, they would have realized that the storefront was to became showcase for fun and interesting gadgets. And that once the customers tried the product, few would actually purchase. Prices steadily increased to pay for premium retail locations and inventory carrying costs. To combat this, the Sharper Image determined to lower costs and to get even more product into the market by going back to a catalog format without changing or lowering prices on products that nobody really needs. The Sharper Image focused on the ‘cool’, innovative ‘gadget’ technology and not customer purchasing criteria and need. The Sharper Image is gone.

The Afterburner Group has accurately connected markets to businesses in the technology, energy, services, manufacturing and non-profit industries for over 25 years.

If you think that you need to reconnect with or improve how you integrate the market into your business, fill out the contact form below and we’ll explore how to do this and how you’ll benefit by new opportunity and profitable demand.

© Afterburner.Group. All rights reserved.

Contact Afterburner.Group

Why consider us?

We are the leader in connecting complex, technology and engineered products, services, companies and brands to sustainable profitable demand.

If you're looking for growth, let's make it happen.

See things differently to create new opportunity and grow business value.